I thought it might be beneficial to others as well as myself to strip down and bare it all. So, how much do we make and where does it go? My husband is the only one with a job right now, and most of the income is from over-time hours.

He mentioned that he made about $15,000 last year from over-time alone. That over-time is never guaranteed and is always variable. So, I will be using a flat 40 hours per week for the calculations and it will be after taxes and all other deductions. We are currently contributing 6% pre-tax to the 401K.

Apparently after all the deductions with no over-time, the bi-weekly income is $1,105.46 so let’s round it to $1,100.00 for the Root Income. Now, on to expenses (You can click on the images below for a larger view):

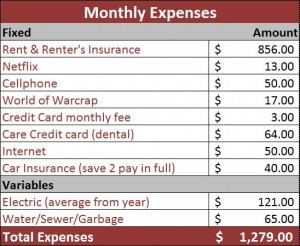

These are just what we currently have to pay. We could drop some of these to save money, but right now these are our commitments. Obviously, I have left out things like groceries, gas and other stuff. Since most months have 2 bi-weekly paychecks, I could divide all of these monthly expenses and pay 1/2 ($639.50) each paycheck. Doing that would make for a more stable budget.

Root Income: $1,100 bi-weekly

Bi-weekly expenses: $639.50

Left after expenses: $460.50

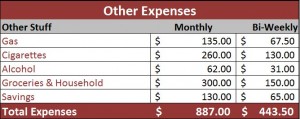

That leaves us with $460.50 for everything else for 2 weeks. What else do we spend money on?

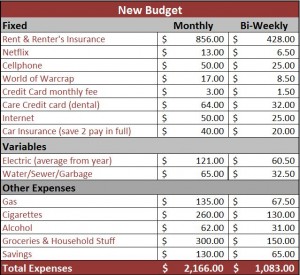

$17.00 left-over in our budget using our Root Income. What’s left can go towards additional savings, entertainment, paying off the evil Care Credit card, clothing, dining out or whatever we think of. Learning to live off of the Root Income will allow us better control with our money and enhanced opportunities for savings. If, over-time the checks average out to $1,250 each; that would be an additional $3,600.00 a year to work with on our terms. If you haven’t already read my post about Root Incomes & Blissful Budgeting, you must think I am nuts. Anyway, I am going to try out this new budget and see how it goes. Our new budget: