Financial literacy is something we should all have but unfortunately not all of us do. Getting our heads round all the financial terms can often be a headache but it is important that we are all aware of our finances and any problems that should arise.

Financial literacy is something we should all have but unfortunately not all of us do. Getting our heads round all the financial terms can often be a headache but it is important that we are all aware of our finances and any problems that should arise.

Debt is one such problem that can spiral out of control if not financially literate. Survey results have shown that plenty of people don’t understand the difference between good and bad debt and sometimes can potentially make the wrong choice. Would you be able to differentiate between good debt and bad debt? In fact, do you have debt and you aren’t sure of which yours is?

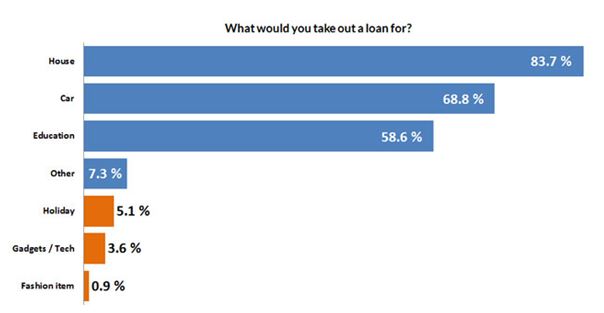

A recent survey conducted by Wonga SA found that when over 18,000 of their South Africans were polled, 83.7% of people would take out credit to buy a house and 58.6% would do the same for university education. These are considered good debts as they are for advances in your life – broadening your education or starting a family. However, 5% would borrow for a holiday and 4.5% for things such as gadgets and fashion. These are considered bad debts – these are items or things that people spend money on that aren’t for the long term but for short term pleasure generally.

When it comes to financial literacy, there are three important things to ask yourself before making a purchase:

- What’s it for? Is it for the long term or for short term pleasure?

- Can you afford it? Have you got savings or available cash you can use or will you need to use credit? Can you afford the credit repayments?

- What will it cost you? If using credit, what interest rates are you likely to incur?

Is it for a good debt, something that will benefit you and/or your family and friends in the long term – or is it for something short term, such as a holiday or the latest smartphone until the next new model comes along and you want to have that one instead? If taking out credit, can you afford to repay said credit once you have borrowed it or is this something you would struggle with? Have you considered the overall costs of taking out credit – how much interest are you paying on it, what amount does that mean you need to pay overall? These are all major questions that everyone should ask before making a big purchase and these are important to stop yourself from getting into dire financial situations.

We’ve all heard stories about people finding themselves in massive amounts of debt and not being able to see a way out. By being financially literate, knowing your worth and what you can realistically afford to spend and maybe even taking control of the situation by making major changes to your lifestyle and/or spending habits, you can save yourself from getting into sticky situations that you may find harder to get out of than just days before.