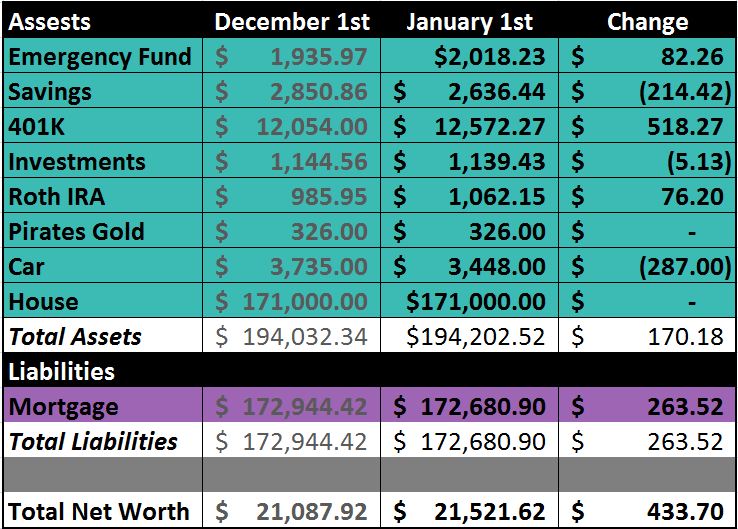

Better up than down.  We’re finally done with the blackout period that came with the company switching the 401k. So all of these numbers, except for the 401k amount (number from 18th), are from the 1st of January.

We’re finally done with the blackout period that came with the company switching the 401k. So all of these numbers, except for the 401k amount (number from 18th), are from the 1st of January.

I don’t like blackouts, the account balance said $0.00 and that just kept creeping me out. Too bad they didn’t add a match while they were switching things up.

Emergency Fund: Up $82.26. This is the result of daily transfers and some money I threw in to make sure I’d get to my goal of $2,000 for the year.

Savings: Down $214.42. This is a total for the following accounts:

- Health & Dental Fund

- Puppy Expenses

- Car Expenses

- Travel Fund

- Europe Trip

- Christmas 2012

- START account at US Bank

- House Fund

We used the money we had been saving up for Christmas to buy presents. No big surprise.

401K: Up $518.27. I don’t know what this is all about, but we’ll take it with a smile.

Investments: Down $5.13. It happens, thankfully it isn’t enough to get me worried. I was hoping to start adding more into our investment accounts this year, but it seems rather unlikely since we’re trying to pay cash for a car. Maybe next year.

Roth IRA: Up $76.20. Things are looking up a bit, but mostly it’s due to adding $25 each paycheck.

Pirates Gold: no change. I’ve been contemplating just cashing these in lately. We’re not adding to them, so they’re just sitting there and frustrating me each time I update our net worth.

Car: Down $287.00. This jumps around so much anyways, it’s hard to surprise me anymore.

House: No change. At least as far as we know.

*******

Liabilities: (Mortgage) Down $263.52. It’s getting there, little by little. I’ll just keep making payments, and it will keep slowly dropping.

So, how did your Net Worth turn out this month?

Have you done it yet???

Nice job! Always better to have an increase than go the other way. Great that you increased the emergency fund, it’s something far too many people dismiss but they shouldn’t.

Digital Personal Finance recently posted..How Often Do You Upgrade Your Phone?

The daily transfers make it so much easier to put money in the Emergency Fund, otherwise, I would probably allocate it elsewhere.

Jen Perkins recently posted..Saving Money: Daily Transfers Update

It’s sometimes frustrating when tracking net worth and it doesn’t move much. You just have to keep focusing on where you are headed and that even little increases are helping you to reach those goals!

Jon @ MoneySmartGuides recently posted..3 Tips to Finding a Reputable Bankruptcy Attorney

As long as it’s up, I’m a happy camper.

Jen Perkins recently posted..Amazon’s New Feature: AutoRip (Free MP3s)

I’m afraid of what my numbers are going to look like at the end of the month. Thankfully, it’s only temporary and by the end of February everything should recover.

Edward Antrobus recently posted..Do’s and Don’ts of Free Wifi

Jen Perkins recently posted..Cold Hard Cash Can Change Everything

Thanks for sharing. It is never easy to put yourself out there. Any positive is a win.

Kim@Eyesonthedollar recently posted..How to Retire in Ten Years, Regardless of Your Age

Exactly.

Jen Perkins recently posted..Why Didn’t I Get A PrePaid Cell Phone Sooner?

Ouch. Your mortgage more than the house value. Pray for some inflation….!

But as you are young there is time for investments and other income to sort this out. Well done, particularly on the 401K.

John@MoneyPrinciple recently posted..January – Time To Get Financially Fit

Our mortgage is more than our house because we just bought our house and the guarantee fee (like PMI) was included in the loan.

Jen Perkins recently posted..Saving Money: Daily Transfers Update

Moving in the right direction that’s all that matters! I never get too caught up in my monthly updates as long as the number keeps moving upwards

The First Million is the Hardest recently posted..Do You Really Need A Financial Advisor?

It sure is.

Jen Perkins recently posted..Amazon’s New Feature: AutoRip (Free MP3s)

I do not include my car in my net worth. It is such a rapidly depreciationg asset that comes with so many expenses (insurance, registration, gas, mainentance) that it is listed in the expense area.

Do you track how much you pay to mortgage interest? There is a change to the amount that (I am guessing) is the total amount of the principle of the loan but nothing to track how much interest is paid.

It might change how you allocate your funds if you see how much is going to the bank every month. Paying interest burns me.

Jane Savers @ The Money Puzzle recently posted..What If I Have To Buy A Newer Car

I hate paying interest too. I look over the mortgage statements each month and they list the amount applied to the principle, paid to interest and added to our escrow account.

Jen Perkins recently posted..Cold Hard Cash Can Change Everything

Yay for an up! Just a few more month and you’ll be back on track with the mortgage. I track once a month, but haven’t done January yet. Should be good as I paid down some debt.

Pauline recently posted..13 money resolutions for 2013: #11 give back!

Congrats on paying down some of your debt, that always feels great.

Jen Perkins recently posted..Why Didn’t I Get A PrePaid Cell Phone Sooner?

Good job going up! Just a little bit of progress is all you need.

My Money Design recently posted..What is Financial Freedom – The Easy to Follow Explanation

Thanks. We’re slowly getting there.

We’re slowly getting there.

Jen Perkins recently posted..Saving Money: Daily Transfers Update