This is my 10th installment for this series.

The basics:

- I applied and was approved for a $3,000 credit limit on 4/12/11

- On the same day ( 4/12/11) I charged a complete root canal & filling on the card = $2,297.00

- 48 month promotional period = 14.9% APR

- Minimum monthly payments = $64.00

- If I paid only the minimum payment of $64.00, in 4 years it would be paid off. I would have paid $3,095.00, which is $798.00 in interest.

- If I paid $80.00 a month, I would have paid $2,887.00, which is $590.00 in interest.

THE TENTH BILL

Previous Balance- $402.31

New Purchases- $0.00

Payments- $214.50 ($70.50 posted on 1/9 & $72.00 posted on 1/18 & $72.00 on 2/2)

Credits, Fees, etc.- $0.00

Interest Charge- $3.90

New Balance- $191.71

Minimum Payment Due- $64.00

Days in Billing Period- 31

TOTAL INTEREST CHARGED: $132.46

TOTAL PAYMENTS SENT: $2,216.50

Notes: Closer again, but not quite there. I’m going to try really, really hard this month to see if I can pay this off while still achieving my other financial goals. I’m not sure if I can, but I’m sure going to try. It’s looking like all together I’ll have ended up paying about $140.00 in interest, it sucks in general, but sometimes it’s good to feel the pain.

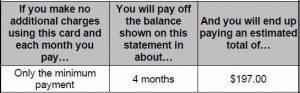

If I keep making only the minimum payment from here on out:

Consumer credit is the bane of many people these days. I almost wonder if I should just join the crowd that has previously made a killing investing in beer and tobacco products, and simply cash in on our addiction to debt. Visa and Mastercard anyone?

lol. I’m just happy this is our only debt.

So.. one more payment on this card? Or, will you string it out and tempt fate by having a “Life of the evil credit card – Part 13!”and post it on a Friday?

haha. No, I definitely don’t want to have this series make it that far. It all depends on our paycheck, if it’s possible to do, I’d like to pay it off this month. I do already have close to $200 in other things I need to do financially, so well see.

My husband and I have a care credit card. We actually used it for his last dental work. It cost around $1500 over about 6 or so visits but instead of paying each visit individually the dentist office charged the total upfront to the card. Since they did it this way we got 18 month on the card at 0% interest. Just wondering if you were given that option?

I was offered the 0% interest but for only 12 months. Our income wasn’t high enough to make me feel comfortable for almost $200 payments each month. I didn’t want to get behind and then get the penalty (29.99% APR) on whatever was left on the bill. I think being charged interest has kept me motivated to pay it off.

Great job getting 0% APR for 18 months, I would have been tempted if I was given an extra 6 months.

You are so close! You’ll have to throw a party when the debt is gone…just don’t celebrate with any sticky sweets…got to protect that dental work!

I know, it’s making me all anxious. I could go on a big shopping spree to celebrate, that would be fun. Just kidding.

Congratulations on not paying interest and soon being rid of that debt!!

Thanks So Random, but I’m actually paying 14.9% on it. It’s been pushing me to pay it off quicker.