[ What a b*tch! ] This is my 5th installment for this series. If you haven’t read the previous installments or if you want to refresh:

[ What a b*tch! ] This is my 5th installment for this series. If you haven’t read the previous installments or if you want to refresh:

Part 1 – Part 2 – Part 3 – Part 4

The basics:

- I applied and was approved for a $3,000 credit limit on 4/12/11

- On the same day ( 4/12/11) I charged a complete root canal & filling on the card = $2,297.00

- 48 month promotional period = 14.9% APR

- Minimum monthly payments = $64.00

- If I paid only the minimum payment of $64.00, in 4 years it would be paid off. I would have paid $3,095.00, which is $798.00 in interest.

- If I paid $80.00 a month, I would have paid $2,887.00, which is $590.00 in interest.

THE FIFTH BILL

Previous Balance- $1,119.94

New Purchases- $0.00

Payments- $199.00 ($100.00 posted on 8/15 & $32.00 posted on 8/23 & $67.00 posted on 8/30)

Credits, Fees, etc.- $0.00

Interest Charge- $12.85

New Balance- $933.79

Minimum Payment Due- $64.00

Days in Billing Period- 30

TOTAL INTEREST CHARGED: $95.29

TOTAL PAYMENTS SENT: $1,458.50

Notes: I’m so happy to finally have the balance on this card under $1,000 and can’t wait until it’s paid off. So far, I’ve managed to pay off about 60% of my balance and I’m feeling better with each payment I send in—no matter how small.

The other day, a fellow blogger commented and asked why I don’t just pay it off with our savings. Oh, I’ve thought about it so many times, but in reality it just wouldn’t be as beneficial to me. I know that I’m paying interest, $95.29 so far but that’s (in my opinion, for our circumstances) okay.

If I were to just take the money from savings to pay it off, I wouldn’t replace it with the same urgency as I would make payments on the card. I also wouldn’t really remember how bad I got burned from adding some debt back into our lives. If I end up paying around $140.00 in interest but take something away from this experience, such as avoid repeating the same mistakes in the future, then that will be a $140.00 well spent.

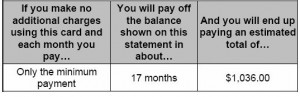

Actually, I guess until we get health insurance, this card might keep getting used (I need to keep looking for inexpensive insurance) but I wouldn’t run up balances on other cards and such. Everybody is different and some things work better/differently for others, but for us…this is the right choice. If I keep making only the minimum payment from here on out:

Credit cards are an unfortunate evil sometimes. 2 years ago my wife and I had to use a credit card for some medical bills. It totally sucks adding debt to your finances – especially when it’s a credit card – but sometimes that’s how life goes.

Good for you though on paying it down quickly.

Thanks Jeremy; hopefully life doesn’t go that direction again. Evil, icky credit cards suck!

Credit cards are not evil i themselves, however irresponsible handling of the credit card can cause significant damage.

I just call it the evil credit card because of the high APR and the fact that I had finally become debt-free before this. 😉

I recently had an unexpected incident occur, so I charged it to my recently paid off cc. I often get asked why I didn’t just use my savings, but I view it just like you do. I would not save money as quickly as I would pay off the credit card. I hate being in debt so the credit card will be paid off quickly. However I wouldn’t feel the urgency to build my savings back up as fast. I am glad I came across someone who thinks its not crazy to pay interest when you have the money to pay the bill.

I’m glad too; I thought I was the only one out there. 😉 I actually wrote about this kind of thinking a week ago, the post is Sometimes It’s Good to Feel the Pain…of debt. If you’re interested in checking it out, it’s at: http://www.mastertheartofsaving.com/2012/01/24/sometimes-its-good-to-feel-the-pain-of-debt/