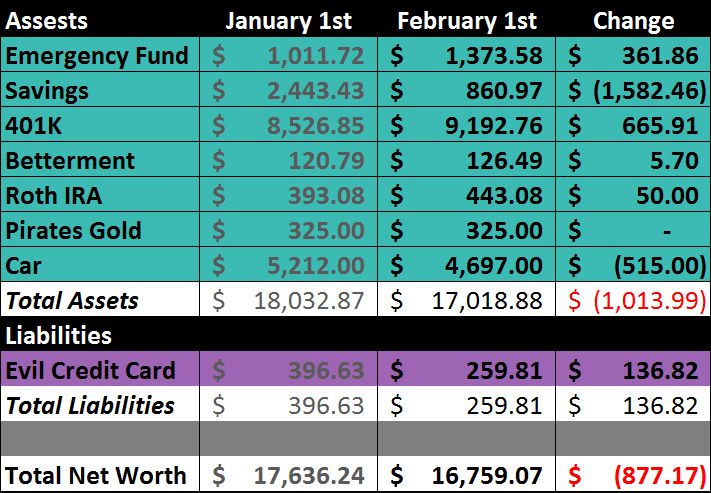

Overall, we’re down $877.17 this month—but strangely, I feel good about it. We saved a good amount of money this month, contributed to our Roth IRA, increased our 401k contributions and paid more on the Evil Credit Card. We also paid for the conference in September and turned it into a little vacation, so that’s better than blowing it all at a casino or something.

Emergency Fund: Up $361.86. Awesome! We were lucky enough to get some fatty checks this last month, which I took advantage of. I’m feeling really good about getting our Emergency Fund up to $2,000 this year; h0pefully there will be more overtime in our future.

Savings: Down $1,582.46. Ouch! I took money from our savings to cover the conference costs and to pay for my January giveaway. I’m pretty much hoping to replace that money since I’d planned something for it. I’ll just have to adjust my plans and do my best to put the money back.

401K: Up $665.91. Very nice to see, especially since we only contributed a couple hundred bucks this last month. This should start growing a little bit quicker because I just increased our contributions from 6% to 8%. I love months like this.

Betterment: Up $5.70. I still haven’t been putting money into our Betterment account, so this is all earnings. Woo hoo! Now I’m kinda wishing that I had continued putting money in here, but it’s okay. We’re currently focusing on other areas and will come back to this later.

Roth IRA: Up $50.00. Sending money to our Roth IRA each month is kinda like a nice new habit. Of course I know we need to be putting away WAY more than this, but right now this is what we can do. Fifty bucks each month is a lot better than nothing, some people would be thrilled to be able to do it.

Pirates Gold: No change. This ‘no change’ every month is starting to drive me nuts. Maybe I’ll just grab a couple each time I go to the bank, I know it’s silly, but it’s nice to have even a small increase instead of nothing.

Car: Down $515.00. Up and down, up and down. This is a down month, last month was an up month. It’s amazing how the value of a car can change so drastically each month. Hopefully next month will see an increase.

Evil Credit Card: Down $136.82. Each time I send a payment, I get more and more excited. I’m thinking 2 more months of payments, and it’s gonna be eliminated—assuming I can swing that financially.

So, how did your Net Worth turn out this month? Have you done it yet???

Even though you’re down, like you said, at least you spent it on good stuff.

Yep. It’s still kinda weird that I’d be fine with it, normally I’d imagine being sad. I guess sometimes it’s all about what you do with the money.

It’s still kinda weird that I’d be fine with it, normally I’d imagine being sad. I guess sometimes it’s all about what you do with the money.

Yeah I see no reason to be down considering what you spent it on. Sometimes you gotta spend money to make money. I’m new here, but is there a reason you calculate the car value again each month? You might’ve mentioned why in a previous post.

I calculate it every month because that’s what everybody else was doing when I started tracking our Net Worth. I know the values change weekly, but I only update once per month. We’re not going to sell our car anytime soon, do you think I should just keep it the same and update it annually instead???

If you are keeping a true running total of net worth, I guess it’s worth the time to check each month. To me it just seems a bit counter productive in that it wastes some time and rubs it in your face that your car is worth less and less. I’m new to blogging though. So maybe people do want to see accurate numbers. Some people do the income vs expense tracking instead, but it probably all depends on what your readers want to see and what they’re used to.

I guess I’ll keep doing it the way I have been, since it’s become a habit every month. If everybody starts complaining about it, I can always switch things up later on.

How do you like Betterment? I never heard of it before, but it looks interesting… Sort of like Vanguard with low-fees, but with investment advice built-in.

Personally, I really like them so far, it’s just so easy. I actually have a page with a little bit of info. and shows what I did; if you’re interested. It hasn’t been updated lately because WordPress has been out to get me. It’s here: http://www.mastertheartofsaving.com/betterment/