Capital One 360 (formerly ING Direct) is by far the best bank I have ever used, and I’m always bragging about how awesome they are. After mentioning numerous times that I setup daily transfers (Monday-Friday) to help us save money, I figured it was time to share how to do it for those who don’t already know. You can click all the images below to see a larger version.

Note: All the images below were taken prior to the switch from ING to Capital One 360, but should still look relatively the same and still be just as useful. More than anything, the colors and name are the only things that have changed. Thank goodness.  If you find it too confusing with the older pictures, let me know and I’ll add it to my list.

If you find it too confusing with the older pictures, let me know and I’ll add it to my list.

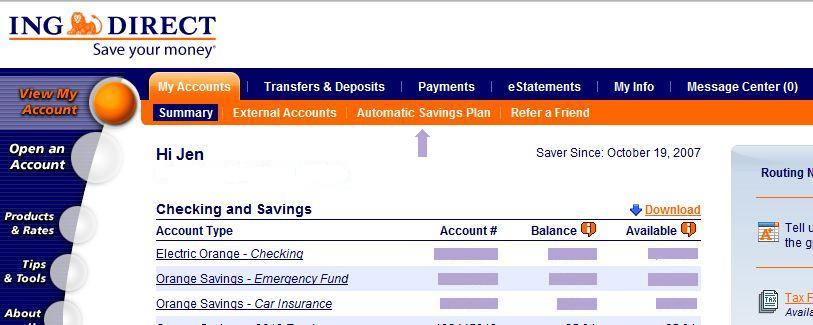

#1 Log-in to your Capital One 360 account

#2 Click on Automatic Savings Plan in the menu

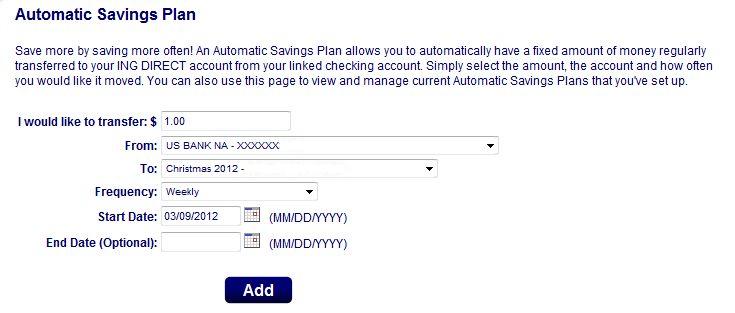

#3 Fill out the information for your transfer and then click the Add button below

I would like to transfer- This is the amount that you want to be transferred each weekday. If you’re wanting to have a weekly total of $5.00, then you would enter $1.00 since this is for 1 day a week. For this tutorial, I’m setting up daily transfers of $1.00 each.

From- Which account do you want this money to come from? I always use our US Bank checking account where we receive our paycheck by direct deposit. You will see all your Capital One 360 accounts as well as your external accounts in the drop box. Just select the one you wish to use. For this tutorial, I’m selecting my US Bank checking.

To- Which account do you want the money to go to? If you have already created sub-accounts, you can choose one of those to help you reach your savings goals or keep things organized. Even if you don’t have sub-accounts, you could just choose the savings account you do have with Capital One 360. For this tutorial, I’m setting up the daily transfer to go into our Christmas savings account.

Frequency- Since we’re setting up daily transfers (Monday-Friday), you’ll want to choose “Weekly” from the drop box.

Start date- When do you want to start having these daily transfers begin? Just pick the Monday you would like to begin.

End date (optional)- You can leave this blank if you want, unless you’re planning to only have these transfers go for a certain amount of time. I left mine blank. You can always go back and change this as well as cancel your transfers.

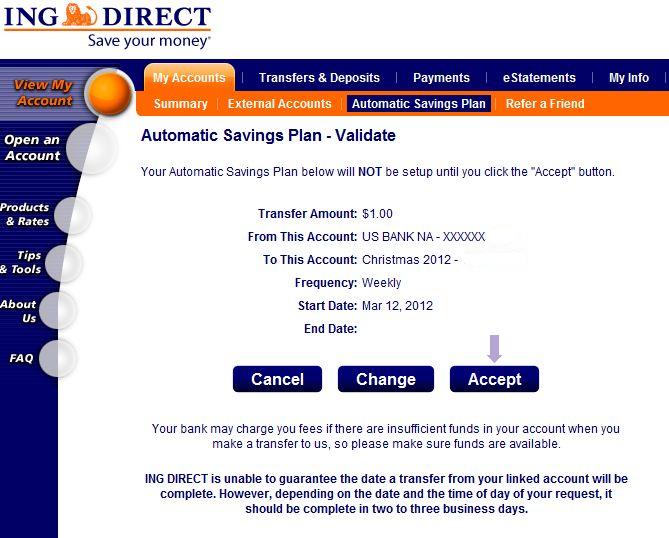

#4 Check the information to make sure everything is correct and then click the Accept button.

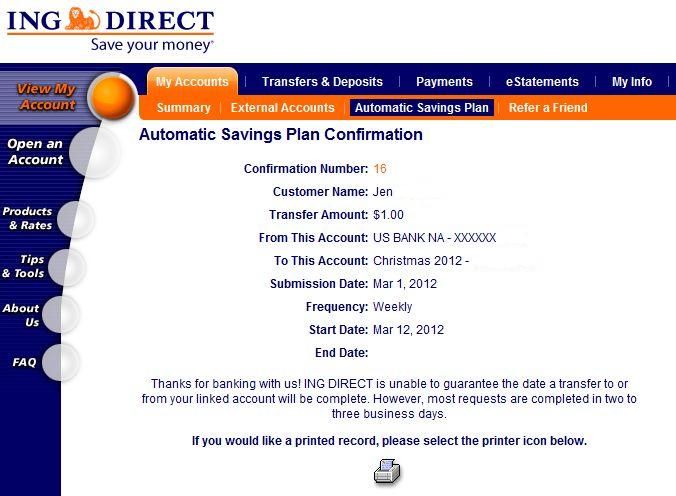

#5 You did it.  You’ll see a confirmation of your first automatic transfer for every Monday now.

You’ll see a confirmation of your first automatic transfer for every Monday now.

#6 Now we just need to do the rest.

- Click on Automatic Savings Plan from the menu.

- Fill out the information again, the same as last time except, this time choose the Tuesday right after the Monday you selected in step 3.

- Review information and click the Accept button.

#7 Now for Wednesday

- Click on Automatic Savings Plan from the menu.

- Again, fill out the form using the same information except this time choose the Wednesday right after the Tuesday you selected in step 6.

- Review the information and click the Accept button.

#8 On to Thursday

- Click on Automatic Saving Plan from the menu.

- Fill out the form with the same information and choose the Thursday right after the Wednesday you selected in step 7.

- Review the information and click the Accept button.

#9 Finally we’re onto Friday

- Click on Automatic Saving Plan from the menu.

- Fill out the form with the same information and choose the Friday right after the Thursday you selected in step 8.

- Review the information and click the Accept button.

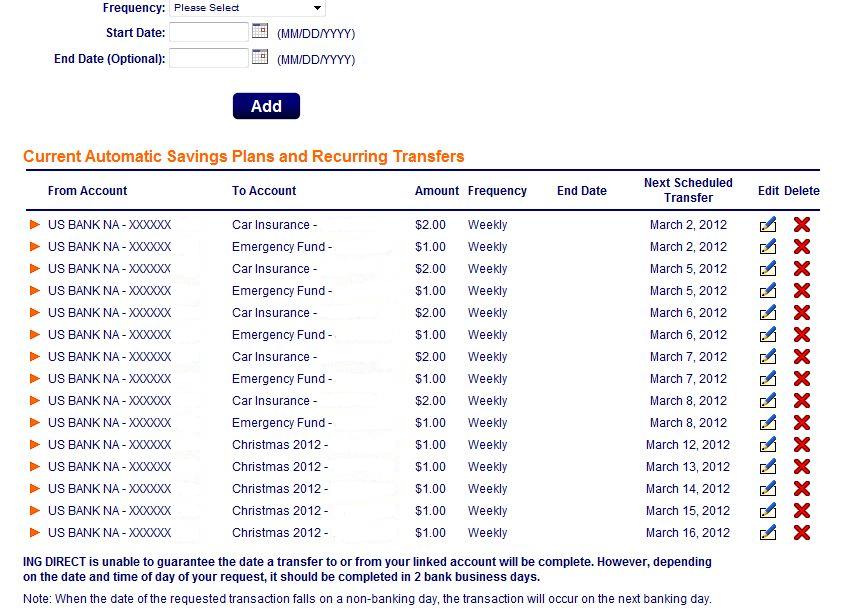

You’re done! You now should have 5 weekly transfers setup for each weekday (Monday-Friday). To see your transfers, you can click on Automatic Savings Plan and find them below the form. I have a lot of daily transfers set up, one to our Emergency Fund, to save for our car insurance and now 1 to save for Christmas. Here’s what mine looks like:

Notes:

- When a holiday falls on a day when you have a transfers scheduled, it usually happens the day after.

- The minimum amount you can setup an automatic transfer for is 1¢, so no matter how much you can afford to start with, you can still begin saving money.

- You can change the amounts as well as cancel your transfers at any time.

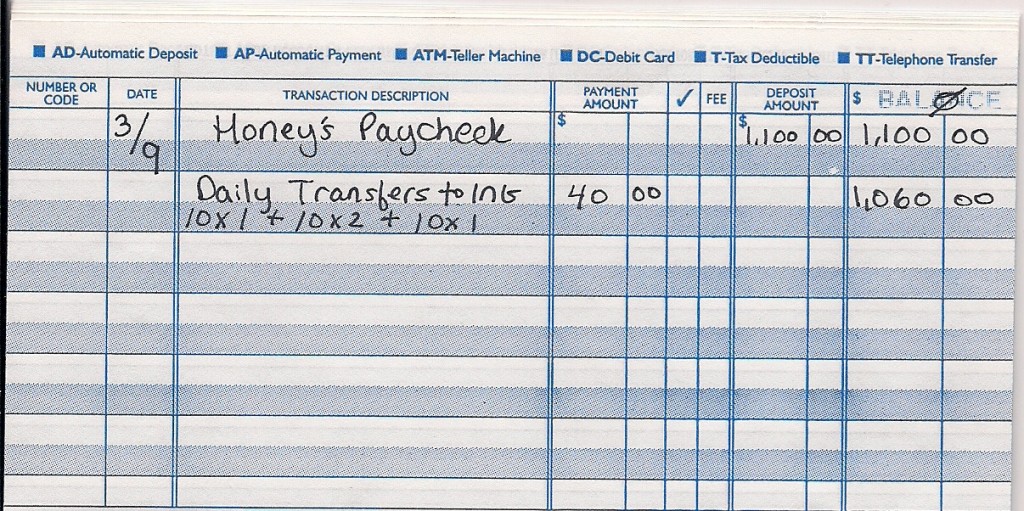

Tip: To keep things simple, I enter the automatic transfers I have scheduled into our register the day we get paid. For example:

The Easiest Way:

In the image, you can see that I lumped all the transfers together. This makes it really quick and easy. We get paid bi-weekly, so each pay-period has 10 weekdays in it. So I just multiply the total daily transfers by 10 days to get the total.

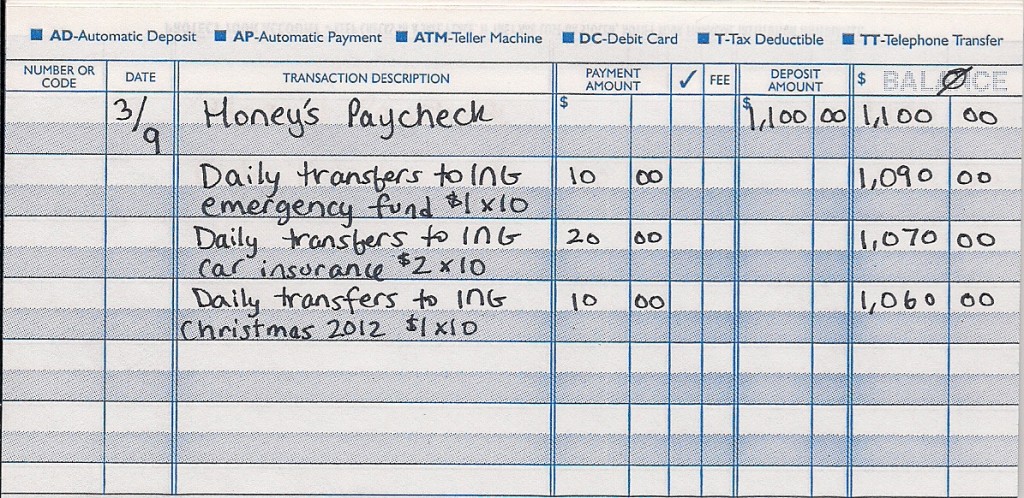

Or, if you want a more detailed way:

Do you use daily transfers to help you save money?

Automatic savings is wonderful. ING is different in Canada than it is in the US but the process is similar I think.

It really is. I never thought about it being different in Canada, I’m stuck in my little bubble I guess. Do you know what the differences are, Daisy?

I never thought about it being different in Canada, I’m stuck in my little bubble I guess. Do you know what the differences are, Daisy?

Very cool Jen! This is a great “How To”. I didn’t know that ING was so easy to set up for small daily transfers.

Thanks Thad. Yep, super easy and quick to get started with daily transfers.

Yep, super easy and quick to get started with daily transfers.

Great resource, thanks Jen!

Thanks Hunter.

I had never thought of doing daily transfers. That is a serious way to make sure the savings work for you. Have you considered using a tool like Mint.com or Adaptu instead of a check register? It could save you a lot of time tracking everything.

I actually signed up (again) with mint to give it another try. I haven’t done anything except for attaching our checking account, but I’m sure I’ll get around to it eventually.

Why do you do daily transfers instead of weekly or monthly?

I like to find different ways to do things. Doing the daily transfers has been great to get us to save money and it’s a bit more of a hassle to stop 5 transfers than just one. It also makes me feel that every day I’m doing something to improve our finances.

Hey, that is really cool. Thanks for sharing this Jen. I am going to look into opening an ING Account.

Thanks After College Money. ING is so awesome, I think everybody should at least give them a shot.

ING is so awesome, I think everybody should at least give them a shot.

I am sending monthly allowance to my mom via bank before until my bank introduced online fund transfer. I just love online transfers!! I need not go out and queue up in banks plus I also save in bank charges. What a total freedom! So glad other banks are adopting this feature

I love online transfers too, they make my life so much easier.