As of August 31st, 2011 my husband has given me complete control over our 401k account. How stressful fun is that? I can make all of the decisions as to where the money goes and how much goes where. I have to admit that I’ve been pretty excited. I must be doing fairly well with our finances for him to think I can handle the 401k, or maybe he just assumes I am. I really don’t think he pays much attention to our weekly spending or our net worth but that’s okay. I’m sure I will do a fabulous job, if not…at least it will be a long time until we find out. lol.

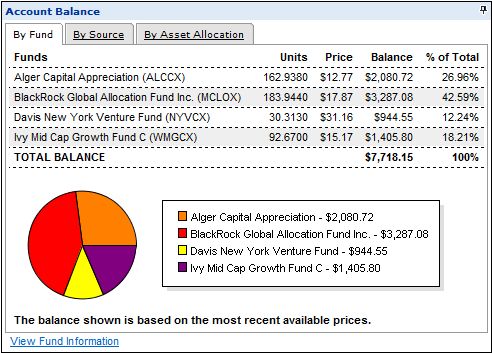

When I came into power, this is how the account looked:

Our Contribution Elections Were:

Alger Capital Appreciation (ALCCX) = 40%

BlackRock Global Allocation Fund Inc. (MCLOX) = 10%

Davis New York Venture Fund (NYVCX) = 10%

Ivy Mid Cap Growth Fund C (WMGCX) = 40%

Husband’s company does not offer a match whatsoever and we contribute 6% each paycheck. The 6% began around Spring 2011 when my honey got a raise, before that, it was 4%.

If you’ve been paying attention to the market lately, you might have realized that it’s kinda sucking. At the end of August our balance was around $7,700 and since then it’s down to around $7,300. Really though, it’s not my fault—I’ve barely done anything yet.

Everything I know about Investing:

♦ Buy low, sell high

♦ Diversify, diversify, diversify

♦ Short term performance means nothing when it’s for the long-term

That’s it. Yep, I don’t know much but I’m going to have to learn. My plans are to increase the amount of funds we are investing in and to obtain shares when their prices are low. Strictly speaking in regards to the 401k. In the future I will hopefully be finding other avenues of investing so that we don’t have only 1 chicken basket. The aquistion of funds and shares will probably take a while; a standard check (no overtime/holiday) only gives us about $94.00 every other week to work with. I have a ton of learning to do.

Who manages the 401k in your household?

Investing on your own will be fun I have a SIMPLE IRA from when I was working for the man. I want to get it moved over to a traditional IRA so I can start contributing to it again (thinking vanguard). Its more on auto pilot.

I have a SIMPLE IRA from when I was working for the man. I want to get it moved over to a traditional IRA so I can start contributing to it again (thinking vanguard). Its more on auto pilot.

For the fun I use buyandhold.com to purchase regular stocks, all dividend stocks. Im not to concerned about the timing of purchases, just as long as I keep adding monthly, but do tend to try and make purchases on down days.

It def. has fun potential once I get $hit figured out a bit more. Everybody seems to do their IRAs over at Vanguard, maybe they’re the best. I’m the only one I know who has theirs over at Sharebuilder and it’s a Roth IRA.

Everybody seems to do their IRAs over at Vanguard, maybe they’re the best. I’m the only one I know who has theirs over at Sharebuilder and it’s a Roth IRA.

I make savings a priority by setting up a payroll deduction and living on what is left. I max out my 403B, IRA and Roth IRA.

That’s awesome Krantcents. I can’t wait until we’re able to max out everything.

If he isn’t getting a match and you don’t seem to be going over 6K savings for the year why not set up an IRA (not roth IRA) – you still get your tax deduction and you’ll have more control over your investment choices?

There are benefits to going the 401(k) route I am just curious about your reasoning.

I’ve actually been thinking of (after I’ve got a better handle on spending) adding in a traditional IRA too and then trying to send about 1/2 the max to each. We still need to work on a lot of things first but hopefully in the next year or two I’ll be able to start doing that.

I can’t offer much feedback on the 401k but I LOVED the fact you used dominatrix in the title- lol. You kn0w how to capture our attention and make finance sexy! 😉

Thanks Shannyn. I do my best to make it interesting.

I do my best to make it interesting.

Good for you Jen! Keep at it and with a little help from the markets your nest egg will grow. Don’t forget to re-balance each quarter. This has the effect of taking some profits from better performing asset classes and putting that money to work in under-performing asset classes.

Thanks Paul. I sure hope so. I’ll keep that in mind, thanks for the info.

I sure hope so. I’ll keep that in mind, thanks for the info.