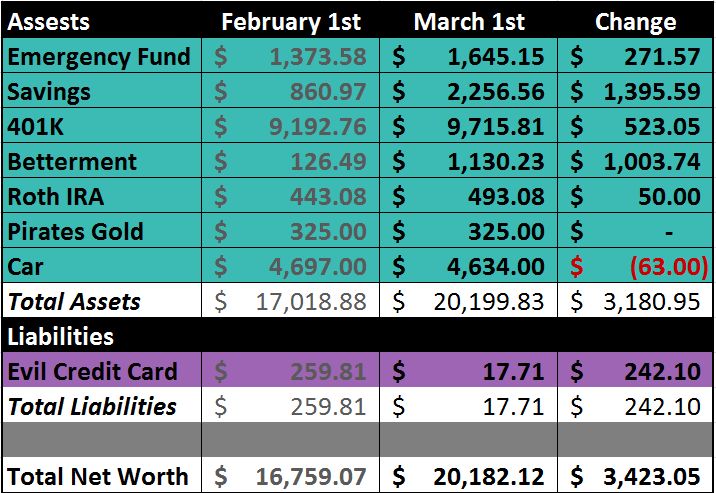

I think this might be our best net worth update ever. A large factor this month was getting our tax refund and implementing my RISE plan, instead of going out and spending it all. We’ve finally made it into the 20’s, that’s amazing.

Emergency Fund: Up $271.57. I’ve been working on getting this up to 2k as quickly as I can so that I can cross it off my 2012 goals and move on to our Roth IRA. It’s been nice having a couple of paychecks with overtime, but I need to get our budget to a place where I can still save a good amount without overtime.

Savings: Up $1,395.59. Most of this is from our tax refund, replacing and saving. Since adding the My Accounts section to this blog, our net worth updates will consist of the following to determine our total savings: Travel Fund, Europe Trip, Christmas 2012, Car Expenses, Puppy Expenses, Health & Dental Fund and our START account at US Bank.

401K: Up $523.05. We recently decided to increase our contributions by 2%, so that helped a bit.

Betterment: Up $1,003.74. I put $1,000 into our Betterment account from our tax refund and the rest is just the market being nice, as well as a tiny bit of dividends. I can’t wait to see how this does with the extra 1k in it. So exciting!

Roth IRA: Up $50.00. I keep making a goal each month to contribute at least 50 bucks to our Roth IRA. Each month I seem to do exactly $50, maybe next month I can do more than the minimum, we’ll see.

Pirates Gold: No change.

Car: Down $63.00. Blah, blah, blah. I guess going down 63 bucks isn’t that bad, it could be worse.

Evil Credit Card: Down $242.10. Yay! I don’t know how I managed to pay it down so much this last month, but I’m not complaining. Now I just need to wait for the interest from February to be added, then I can send off my very last payment. I can’t wait.

So, how did your Net Worth turn out this month? Have you done it yet???

Wow that’s a good update!

Thanks Michelle.

I find my net worth really difficult to figure out. I own two homes and on at least one, the Zillow value is way, way off. I know it’s way off but I don’t know what exactly the house is worth–it’s a unique setup. It’s worth at least 1.5 million but I don’t know how much more, which makes the rest of it kind of pointless. It might be worth 1.7, maybe 1.8. Unless I put it up for sale, which ain’t happening, I won’t know. I guess I could do net worth without house values, but again, what’s the point?

That does sound kind of tricky, Harriet. You could always just use the values you can find, that way, you’ll be able to calculate and track your networth. Letting the difference between the value you can find and the actual value just be a nice bonus later on. Just an idea.

Yay, almost done with the credit card! How exciting to be so close. Next month you can snowball into… the car loan? What’s your plan?

I also have a monthly minimum contribution to my Roth IRA. It sure doesn’t add up to a full contribution, so there are those months where I count on bonuses or gifts or other “extra” money I found or made to get me to my max-out goal.

We don’t actually owe anything on the car, it’s an asset, we paid it off years ago. I’m hoping to be able to finish getting our Emergency Fund to 2k, getting our Roth IRA to 1k and start adding to our other savings accounts.

I’m hoping to be able to finish getting our Emergency Fund to 2k, getting our Roth IRA to 1k and start adding to our other savings accounts.

At least you’re contributing something to your Roth IRA, many people aren’t even doing that. Great job, Remy.

Trending up!!!

😀

Great gains, way to go!

Thanks Andrea.

Great increase Jen!

Thanks Laura.

Nice work – it’s nice to see a positive change in the networth!

Thanks Corey, they’re my favorite kind of change.