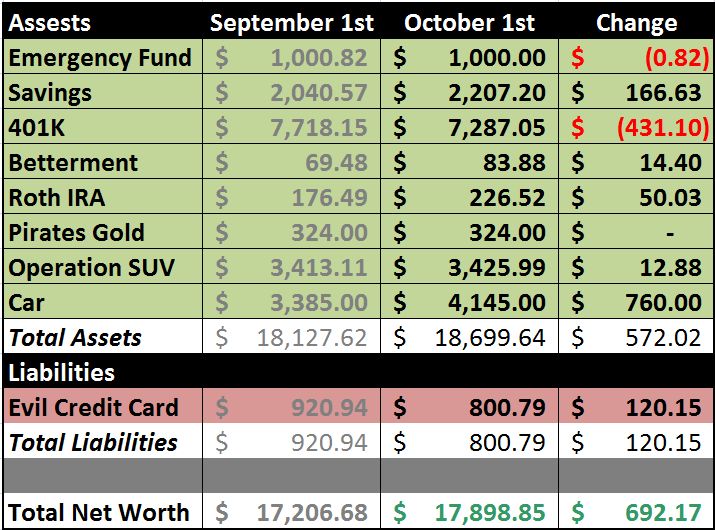

Last month, our Net Worth increased by $2,998.68, which was mostly a reflection of my adding the Operation SUV account to the Net Worth. This month isn’t as grand but a $692.17 increase is still better than going the other way.

Emergency Fund: Down $0.82. Seeing it in red kinda makes me giggle. I transferred everything over $1,000.00 to one of our savings accounts to help build them up.

Savings: up $166.63. I was hoping for more of an increase in our savings this month but that’s okay. At least I was able to save this much.

401K: Down $431.10. Yuck. This is all about the market and isn’t my fault, really.

Betterment: up $14.40. Funny since I threw 20 bucks in there. lol. At least I’m buying more.

Roth IRA: Up $50.03. Still truckin’ along on it’s journey to $1,000.00, slowly but surely.

Pirates Gold: No changes here, but my birthday is coming up. My dad usually gives me gold dollars then, so we’ll see.

Operation SUV: Up $12.88. Not making much progress here but at least I’m still adding something. If I keep things going at this rate, I’ll never be able to afford my SUV, that’s not even taking inflation into consideration.

Car: Up $760.00. Silly Kelly Blue Book—you make my head spin. I’ll take it though, it helps offset the 401k.

Evil Credit Card: Down 120.15. Closer, yet still mocking. Maybe there will be an extra payment to this soon?

So, how did your Net Worth turn out this month? Have you done it yet???

Great updates Jen, I see you got below 200K alexa too congrats!!yeah!

Thanks Aaron. It’s definitely a fabulous day for me.

Brilliant Updates. Thanks for sharing them Jen.

Thanks Rochelle.

Every time I see you post this I’m like “darn it I need to get my net worth in order!” I write about frugality/finance but I haven’t gone over my assets in a year now, yikes! Okay, okay- you’ve inspired me to get back on track and calculate otherwise I feel I’m probably not on board to saving $ as I should be! Thanks for the inspiration!

The first time might not be that fun but every time after is kinda exciting when you see your progress. Good luck figuring out your net worth, Shannyn.

I know adding % really gets me going – 3.8% is a fantastic increase!

That does sound fun, Evan. How do I calculate it? Yeah, I know, I should already know this.

(Change/original) *100

How could I not know that!? Thanks Evan.

Ya mine went down a little bit thanks to wall street jitters, and of course I calculated on a down day.

That sucks. Hopefully you’ll be able to turn things around for next month.

Jen,

Have you considered knocking off the rest of the credit card debt from savings? Your CC post notes that the rate is 14.9%, so assuming your tax is 30% state+fed (I have no idea) you’d have to get 21.3% in the savings account to tread water. Might be worth it to have the debt monkey off your back.

Many times. Financially speaking, it would make sense but for us, we wouldn’t make savings (to replace that money) as high of a priority. I’d love to say we could but I would just be lying. Also, the sting of that interest will help remind me how much debt sucks. Thanks PKamp3.