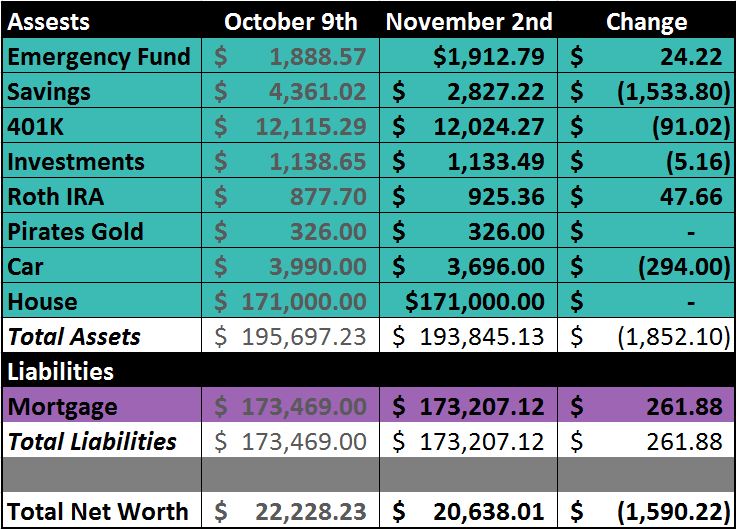

Another month of going down, but that’s exactly why we saved so much. Plus, we’re still in 20’s. It seems kind of lousy that so little was actually applied to the principle (mortgage), but that’s just how the cookie crumbles. It’ll get better and so will our net worth soon, once things settle down some.

Emergency Fund: Up $24.22. This is still just from my daily transfers, nothing more. When I get a chance, I’m going to need to add some more into here to meet my goal of $2,000 for 2012.

Savings: Down $1,533.80. This is a total for the following accounts:

- Health & Dental Fund

- Puppy Expenses

- Car Expenses

- Travel Fund

- Europe Trip

- Christmas 2012

- START account at US Bank

- House Fund

Poor house fund, you’re getting so empty. A lot of the money ended up going to fix our stupid sewer pipe issue, but it was worth every single penny to get it done.

401K: Down $91.02. It was bound to happen. Hopefully we can get back to our regular contributions soon, I’m feeling so guilty about only doing 1%.

Investments: Down $5.16. Last month it went up, this month is goes down…maybe next month it will go up again. We’ll see.

Roth IRA: Up $47.66. We contributed $50 last month, so it looks like we lost a little. Still, it’s better than losing a lot.

Pirates Gold: Never changes anymore. Must get gold.

Car: Down $294.00. Another big drop, I’m beginning to think that KBB is out to get me. Or maybe just out to make me look foolish for putting this in here. Shame on you KBB.

House: No change.

*******

Liabilities: (Mortgage) Down $261.88. Slowly making progress. We just paid our first mortgage payment ever, 1 month down…359 to go. Just kidding, I doubt we’ll actually stay here this long.

So, how did your Net Worth turn out this month?

Have you done it yet???

Love everything you’re saving for! Europe trip…makes me day dream….

I’m not even calculating mine until I know it’s positive again. DENIAL.

femmefrugality recently posted..Help me earn a $10,000 scholarship!

Hopefully it’ll help me get there one day. You never know, tracking it might help you get positive quicker.

You never know, tracking it might help you get positive quicker.

Jen Perkins recently posted..Getting The Most “Bang” For Your Halloween Bucks

It’s tough to see the money go that you worked so hard to save, but I’m in the same boat as you are this month! While our net worth won’t drop too much, our cash position changed quite a bit as we dumped about $8000 on a used car. :/ We also bought a new washer/dryer however the majority of that came from credit card rewards. Oh well…keep your head up and make November a better month! 3 steps forward, 1 step back.

WorkSaveLive recently posted..Recipe: Bacon and Egg Muffins

I wish we had $8k to dump on a used car, it would rock to not be stuck at home all the time. 😉 Ooooh, a new washer and dryer—did you get the front loaders? Those are way sexy.

Jen Perkins recently posted..Getting Back into the Swing of Things

Keep plugging and keep tracking and you’ll get where you want to be.

Marie at Family Money Values recently posted..10 Benefits of Writing Your Autobiography

I sure hope so…it seems like all these expenses keep popping up and it’s pretty lame.

Jen Perkins recently posted..No Mortgage Payments For A Year—Sign Me Up!

24 bucks in daily transfers is pretty decent! My in-laws have it set up so every time they use their debt card $1 is automatically transferred into their Christmas savings. It’s amazing how fast it adds up!

Catherine recently posted..Weekly Reads: 16.11.12

Sounds pretty neat, but I would end up missing something and then over-drafting.

Jen Perkins recently posted..Schools Letting Kids Spend Parent’s Money Without Permission